Automatic Investment Strategy

Manage risk and maximise your savings

There are many events in the future which we may need to start saving for. Now, more than ever, providing for future years can be a source of concern. Not only do we need to review, and often revise, the amount we save, it’s also important to ensure we are comfortable with the level of risk we are taking with our money.

Automatic investment strategy

The Automatic Investment Strategy (AIS) is an automated investment option that allows plan members to invest in growth assets such as equities during the early years of their plan, and moves them gradually into more secure assets such as fixed interest securities during the latter years. The level of risk investors are prepared to take, along with investment growth and their income needs are likely to change throughout the different stages of life – with each stage potentially requiring a different balance within the plan.

Adapts investments to changing needs

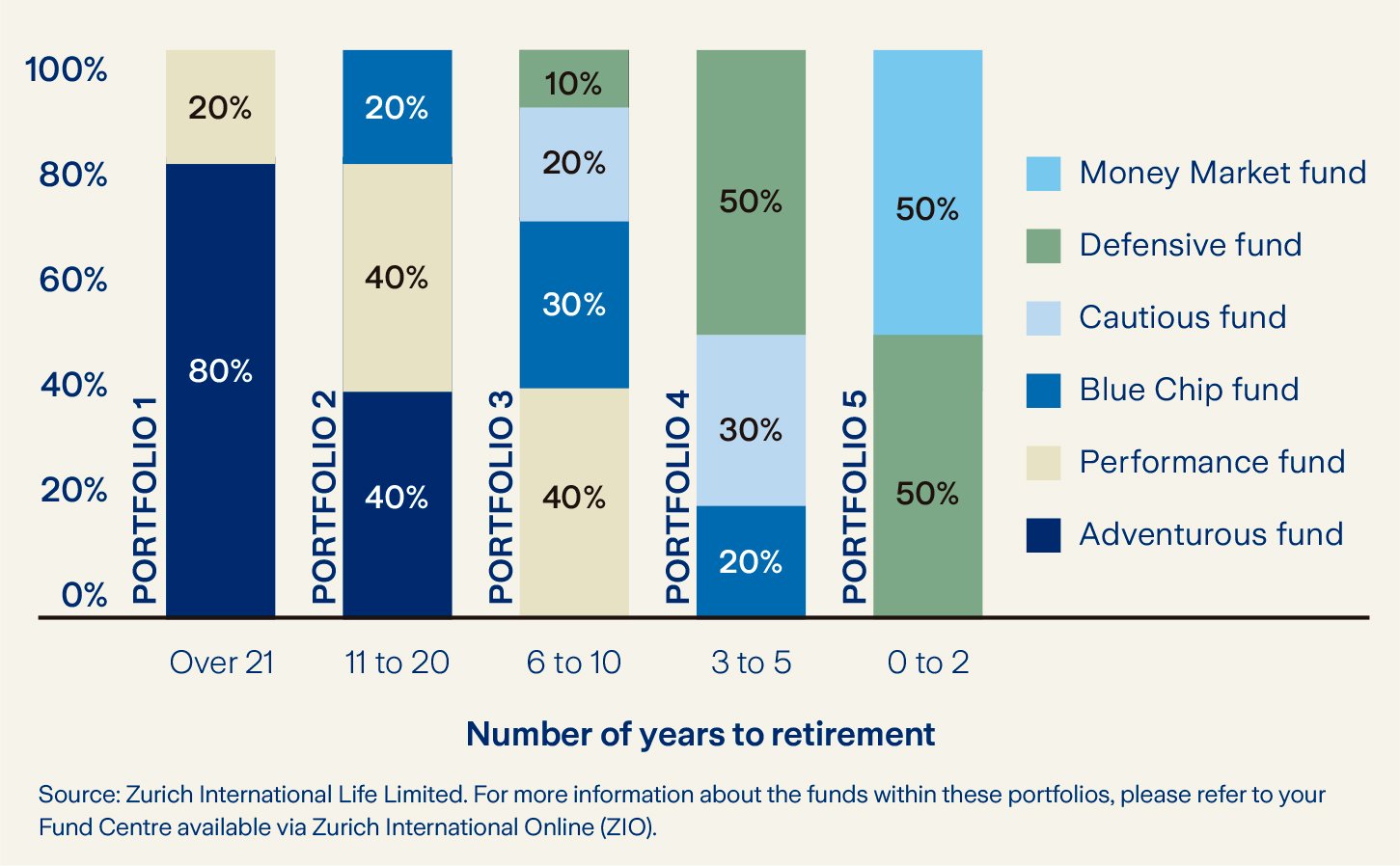

By choosing to invest in the AIS, plan members’ savings are automatically switched from equity based funds to funds investing in fixed interest securities and money markets as they move closer to their policy maturity. This reduces their exposure to investment risk over time and helps to protect any gains made during the early years of the policy. The chart illustrates how this works. The AIS reduces investment risk by automatically switching contributions through up to five investment portfolios, depending on how long is left until a plan member’s retirement, with each portfolio offering less exposure to risk than the previous portfolio. Automatic switching takes place in line with the policy anniversary date.

For example, if a plan member has ten years until their retirement and they select the AIS, contributions will initially be invested in Portfolio 3 which contains the Performance, Blue Chip, Cautious and Defensive funds in the proportions shown overleaf. After five years, at the policy anniversary date, their investment will be adjusted by switching into Portfolio 4 which contains the Blue Chip, Cautious and Defensive funds, eventually ending up in Portfolio 5 which contains the Defensive and Money Market funds for the two years prior to their retirement.

Switches take place at the policy anniversary date prior to the individual’s birthday.

For example:

– Retirement Date 10 December 2024.

– Annual policy anniversary date 1 July.

Assets will automatically switch into the final asset allocation of 50% Money Market : 50% Defensive effective 1 July 2022

AIS invests in a range of Zurich funds.

The Money Market funds invest in short-term deposits, and international short-term interest earning securities, such as certificates of deposit. The objective of the Money Market funds is to provide a low risk environment that offers stability and a high degree of liquidity.

The Managed fund range offers funds of differing risk levels. The funds invest primarily in fixed interest securities and equities listed on the world’s stock markets. The asset allocation within these funds is managed by our fund advisers Columbia Threadneedle Investments according to an investment mandate set and controlled by Zurich. There are five levels of Managed funds, investing in a mixed portfolio of equities, fixed interest securities and cash.

- The Defensive funds carry the lowest risk and invest mainly in fixed interest securities with a proportion invested in international equities.

- The Cautious funds invest primarily in fixed-interest securities but generally carry a higher proportion of equities than the Defensive funds.

- The Blue Chip funds invest in equities and a proportion of fixed-interest securities.

- The Performance funds carry an even higher concentration of equities and exposure to fixed-interest securities is lower than that of the Blue Chip funds.

- The Adventurous funds exposure to equities is generally higher than that of the other funds in the managed range with a lower exposure to money market instruments.

Please note that the value of any investment and income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested. It is recommended that you always seek advice from a relevant financial professional prior to making any decisions.