Become a smart investor

Learn more about smart investing by watching our ‘Investing Basics’ video series. Short and informative, these videos are just what you need to kick off your savings plan.

Define your goals

Everybody needs goals – they lend focus and purpose to life. The same is true when you invest. You’re not building a portfolio because you’ve always wanted a portfolio – you’re building it because you have long-term goals that you want to achieve.

Understand your appetite for risk

This is about selecting the right balance of investments to help you reach your goals. The mix of equities and bonds in your portfolio is likely to be the biggest driver of your future returns – so, once you’ve thought about your goals, choosing the right balance is the next step.

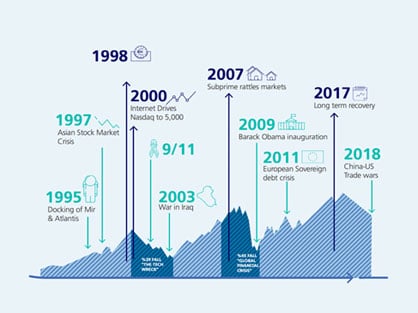

Stick with a long-term investment plan

Having an investment plan is just as important as mapping a route and knowing your destination before you begin a journey. Think of your investment plan as a map to get you to your financial goal. It will help you set your destination and the route that will get you there.

Diversify to manage risk

Diversification within your portfolio aims to reduce risk whilst trying to maximise returns by investing in different equities and bonds that would each react differently to the same event. It’s easy to achieve the diversification you need through mutual funds.

Discipline: avoid the classic investment trap

The most successful investors are often those with the most discipline. It’s a good idea to set an appropriate asset allocation to suit your goals, and then let time and the power of markets do the heavy lifting.