Different approaches to retirement benefits

ArticleApril 1, 2019

In this article we look at the different ways in which multinationals provide benefits for their internationally mobile employees.

As a leading provider of international retirement savings, we’re keen to share our expertise and insights with multinational businesses seeking benefits solutions for their globally mobile employees. Please join us as we explore the world of international employee benefits and the challenges and opportunities they present for your business.

ARTICLE 04

In previous articles we have seen that the growth and geographical expansion of multinationals is leading to increasing international mobility and presenting new challenges for the HR function. We have also looked at ageing populations and how the ratio between those in retirement and those working is predicted to fall leading to substantial retirement savings gaps in the world’s largest economies.

So what solutions are multinationals currently using to help their internationally mobile employees to close this gap?

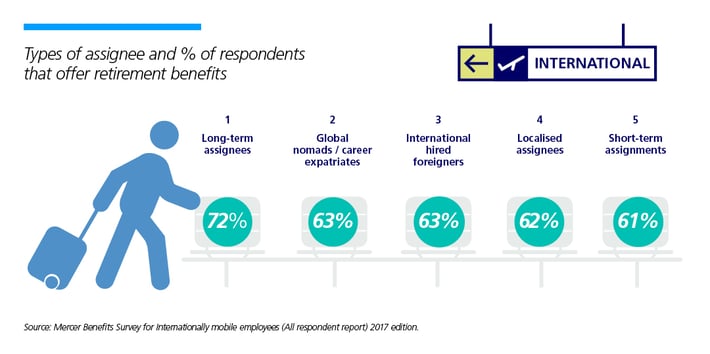

The figures below, taken from the Mercer Benefits survey for internationally mobile employees, show the percentage of respondents that offer retirement benefits, and the type of plan offered for each assignment type.

More than half of the companies surveyed provide retirement benefits to all international assignees other than contractors. As you might expect, the assignment types for which the highest proportion of respondents provides retirement benefits are long-term assignees, global nomads and internationally hired foreigners.

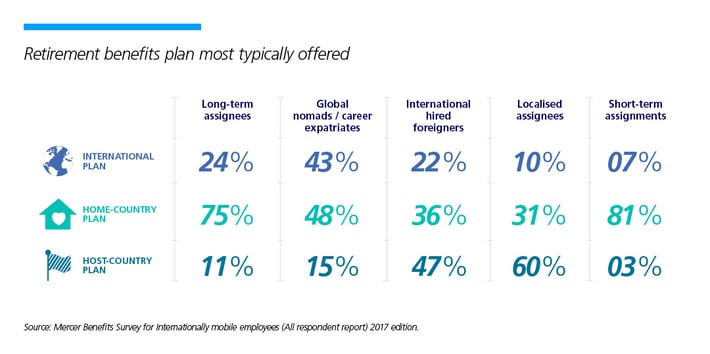

In all cases, employers are offering either a home- or host-country plan and the decision as to which is offered is most likely made according to the overall remuneration approach applied to those assignment types.

According to Mercer, setting retirement benefits at the right level is the most sensitive challenge within the whole benefits package.

While it appears relatively straightforward to determine an appropriate level of benefits to fill the gap of national social security on a purely local employee level, it can become difficult in the international context.

Global nomads offer a particular challenge – what social security basis should be used? The frequency of change and duration of their assignments may not even allow them to fulfil the waiting period requirements for social security pension entitlements. This is probably why the approach to retirement benefits is more diverse for global nomads, with the survey showing a similar proportion of respondents offering an international plan and home-country plan.

The frequency and duration of assignments may not allow global nomads to qualify for social security pension entitlements.

Local retirement solutions are often not appropriate for this group as, particularly outside Western Europe and the U.S., they may have low contribution limits and investment restrictions, such as strategy requirements to invest in local government bonds or investment funds. In addition, building up a pension in a country other than the one where an individual intends to retire, perhaps in a weak currency, is simply not attractive.

Retention in the home-country plan also carries a number of risks and challenges, such as the possible creation of a cross-border scheme, regulatory time restrictions and providers’ inability or lack of appetite to include overseas workers.

It’s important not to underestimate the cross-border risk. Occupational pension plans established in one European country and with members localised in another European country must satisfy the cross-border regulations. This includes creating different country sections and meeting the local social and labour laws of each country, which may mean producing member materials in different languages, meeting local disclosure regulations and so on.

As we have seen, the number of internationally mobile employees is forecast to continue to grow. Not only is this growth likely to occur in different regions to the past, we are also seeing new demographics and expectations emerging among this population. It’s therefore more important than ever for employers to ensure that their benefits solutions are meeting the needs of their employees and their business.

In the next article we will look at the case for international pension plans in more detail.

Find more information about our award-winning International Pension Plan and other savings solutions here.