Funding gaps and increasing longevity: a growing challenge

ArticleApril 22, 2025

According to the World Economic Forum’s Future-Proofing the Longevity Economy Trends white paper, by 2050 the global population aged 65 and older will reach 1.6 billion, with one in six people over 65 in Europe and North America, this ratio will rise to one in four; in some countries, such as Japan, South Korea and Italy, this ratio is projected to exceed one in three.

An Ageing Population

An ageing population means that the ratio between those employed and those retired is expected to decrease. The long-standing balance between the years spent in productive work and retirement is swiftly becoming unsustainable. For many years, the “demographic dividend” – the economic advantage derived from having a larger working-age population relative to retirees – has driven growth in numerous nations. However, with increasing life expectancy and decreasing birth rates, countries are now confronted with the dual challenge of preserving the robustness of economic systems while making certain that younger generations are not overly burdened with future financial strain.

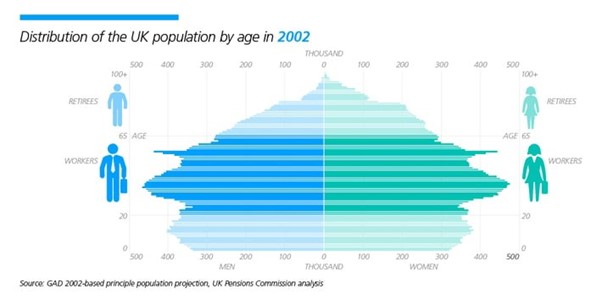

Here’s a graph showing the population distribution in 2002 in the UK with ‘Workers’ and ‘Retirees’ highlighted.

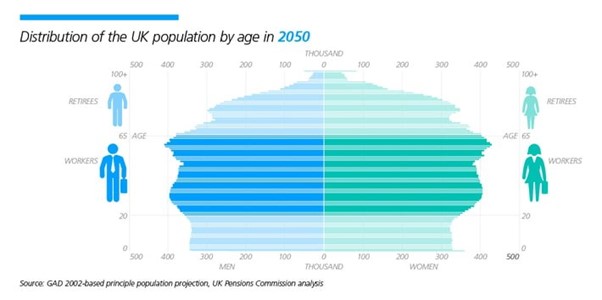

Now here’s the same graph showing the predicted situation in 2050.

As you can see, the ratio of ‘Workers’ to ‘Retirees’ is much lower, and this fall in the ‘support ratio’ is understandably putting fiscal and political pressure on public pension provision.

Individual Responsibility in Retirement Funding

Public retirement systems are a cornerstone of economic security. As life expectancies increase and birth rates decline, these systems face unprecedented challenges. If future society cannot support the burden of increasing dependency, it follows that individuals will have to contribute towards funding their own retirement. But just how big is the shortfall they will have to make up?

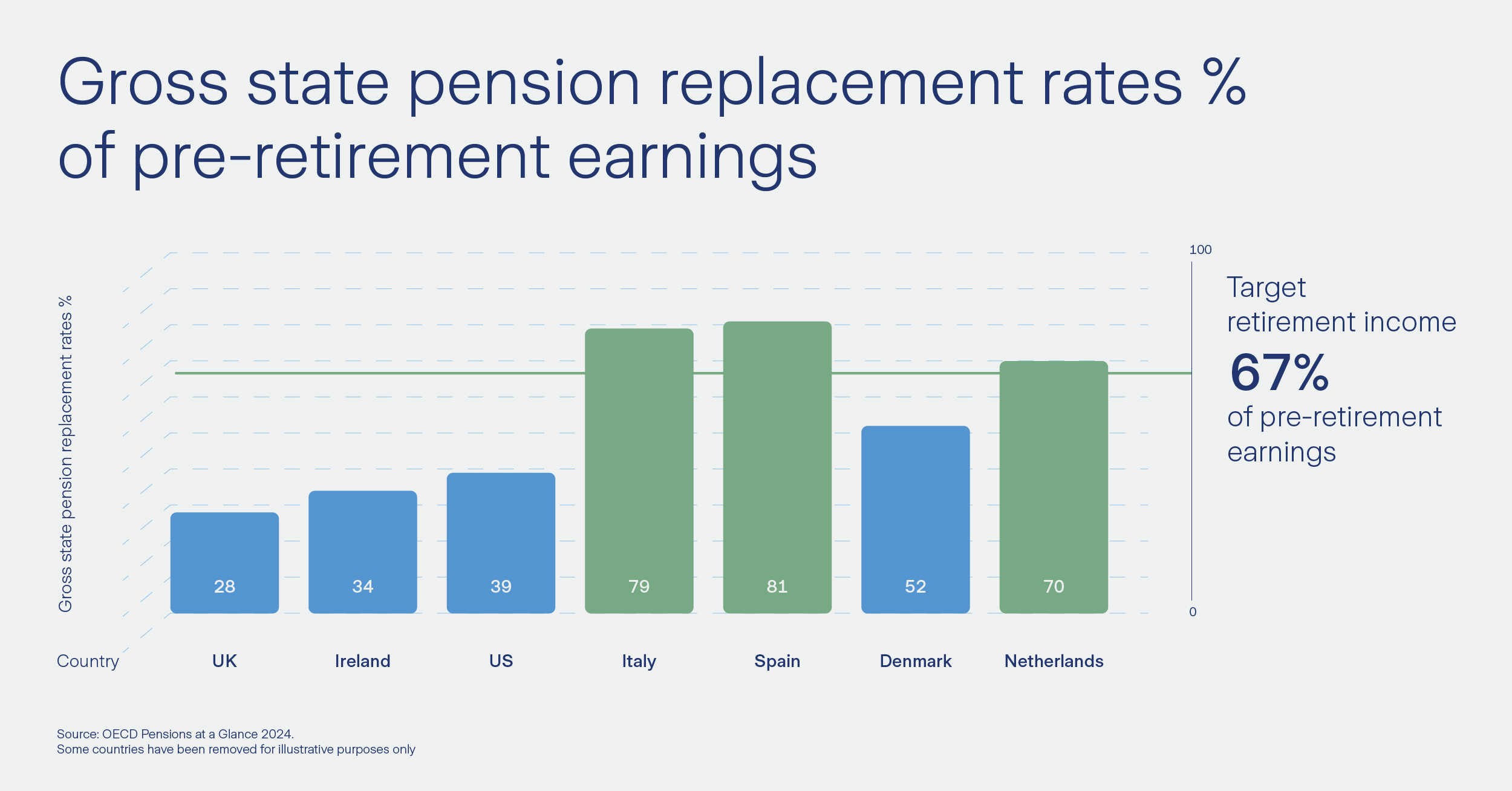

To a certain extent, it depends on where in the world you live. The graph below shows the percentage of pre-retirement earnings currently provided by state pension schemes in selected countries worldwide.

Based on OECD recommendations that savers should aim for a retirement income of 67% of earnings when they stop working, the world’s largest economies have a retirement savings gap of USD 70 trillion, and this is expected to rise to over USD 400 trillion by 2050, according to the World Economic Forum.

Various factors are contributing to this gap, including improved life expectancy, lower investment yields, and the demise of defined benefit arrangements.

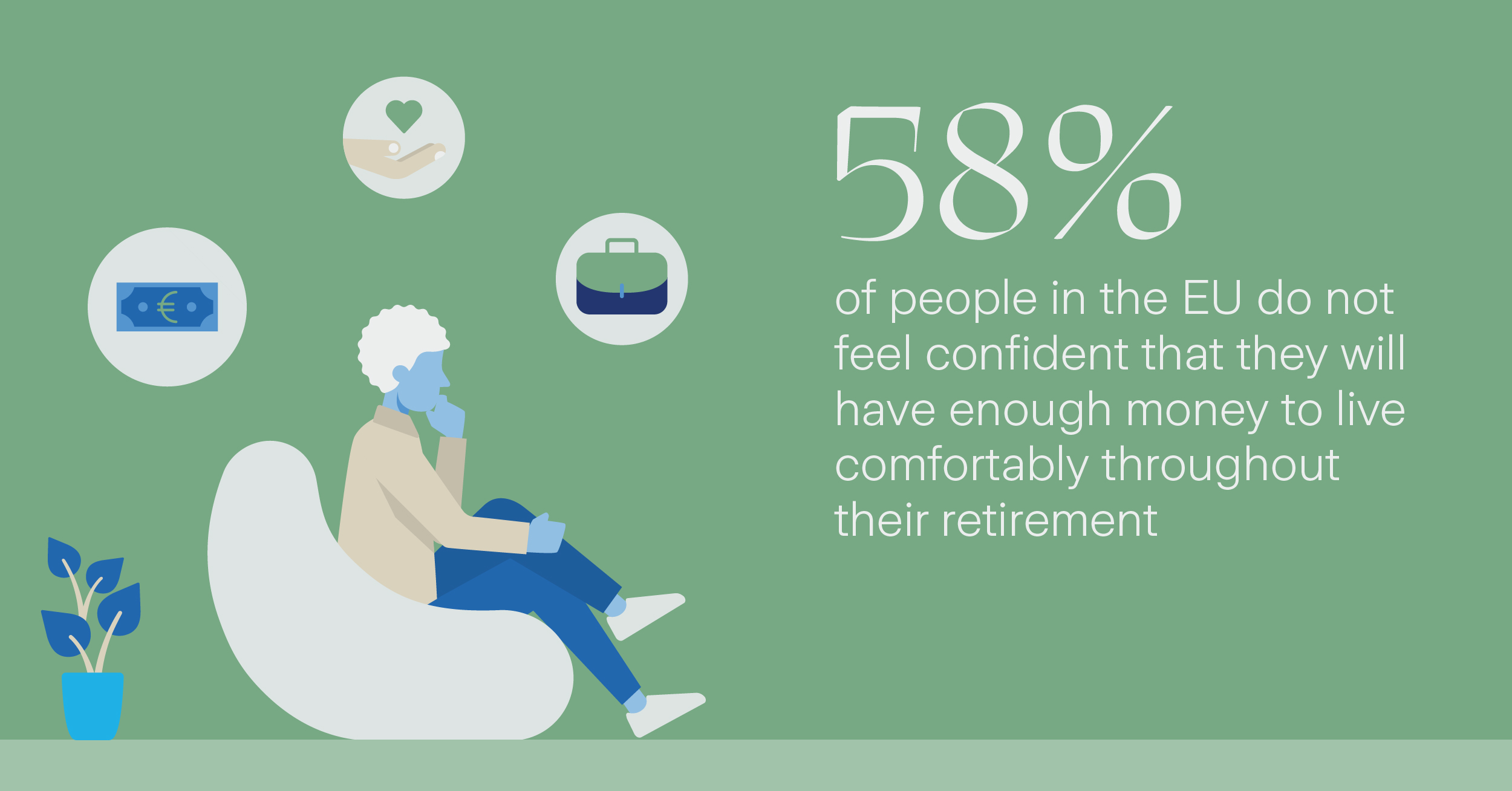

The 2024 Global Retail Investor Survey found that 44% of individuals worldwide fear outliving their savings, with younger generations more concerned than the generation closest to retirement age. Given retirement benefits have generally declined over time, younger cohorts anticipate lower replacement rates than their predecessors.

As the global population ages, the importance of financial preparedness for retirement cannot be overstated. This is especially true for expatriate employees, who often face the added challenge of managing fragmented savings accumulated across multiple assignments.

Longevity Trends and Implications

Creating an inclusive and financially resilient future requires rethinking economic empowerment. To address the retirement savings gap, we need to consider various strategies:

- Increasing Savings: Key considerations are determining how much to save, how long to save, and managing inflation. Smart investments help mitigate inflation risks and ensure savings last.

- Adapting to a Modest Lifestyle: This includes cutting retirement expenses and acknowledging changing norms in family support, emphasizing the importance of a strong social security system.

- Extending Work Life: Assess workplaces' ability to support older employees, considering their performance and the “grey ceiling” effect on younger talent. Inclusive environments that engage older workers benefit both employees and organizations.

Given these strategies to bridge the retirement savings gap, it becomes evident that employer-sponsored retirement savings plans, particularly for expatriates, offers an extremely valuable, and sought-after benefit.

Ultimately, a holistic approach that combines effective savings strategies, employer-sponsored plans, and supportive workplace environments will help mitigate the retirement savings gap. By embracing these initiatives, both individuals and employers can contribute to a financially secure and inclusive future.

Mark Belcher

International Corporate Distribution Manager at Zurich Integrated Benefits

To learn more about the trends in international corporate savings plans reach out to Mark Belcher at

mark.belcher@uk.zurich.com Visit profile

For broader employee benefits insight follow Zurich Integrated Benefits