The value of flexibility

ArticleAugust 1, 2019

In this article we look at the benefits of allowing retiring employees to take regular withdrawals from an international pension plan.

As a leading provider of international retirement savings, we’re keen to share our expertise and insights with multinational businesses seeking benefits solutions for their globally mobile employees. Please join us as we explore the world of international employee benefits and the challenges and opportunities they present for your business.

ARTICLE 09

As we saw in our previous article, it’s possible to take advantage of the inherent flexibility of an international pension plan (IPP) to make it an even more attractive proposition for existing and potential employees.

This time we’ll look at how enabling regular withdrawals from the plan can help an employee’s investment to last longer and provide substantially more income.

Taking regular withdrawals from the plan effectively enables an employee to leave their money invested while drawing an income from their investment, with the following benefits:

|

Payments can be timed to meet actual needs. |

|

|

The timing and amount of regular withdrawal payments can be set to minimise tax implications. |

|

|

The employee has the flexibility to amend the frequency and amount of withdrawals, including cancelling them, at any time. |

|

|

The employee can take the full remaining value at any time. |

|

|

Higher returns from institutionally priced funds. |

|

|

Benefit can continue to grow subject to market performance. |

|

|

No immediate requirement to buy an annuity but one can be bought in the future if the employee decides to do so. |

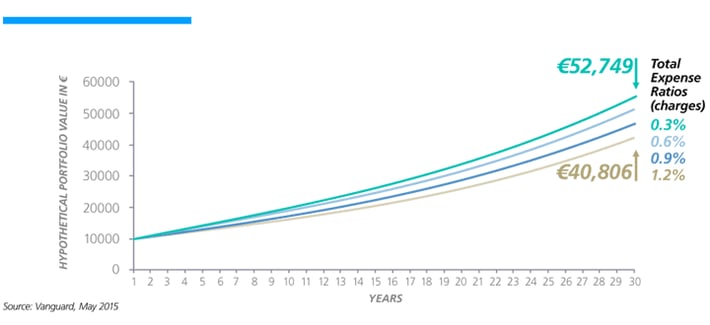

By offering employees investment funds with institutional pricing, employers can help the investment last longer and provide substantially more income. As an example, the following chart demonstrates the impact upon a fund value of different levels of charges.

This hypothetical example (which does not represent any particular investment), illustrates the potential impact of costs on an initial investment of £10,000 over a 30-year period. It assumes 6% average growth per annum which is compounded year on year. As it shows, an Annual Management Charge (AMC) of 0.3% compared to an AMC of 1.2% could potentially lead to additional growth of £11,943 over a 30-year period.

This difference in outcomes highlights the benefits of allowing employees to keep their funds invested in a company-sponsored IPP while taking regular withdrawals, rather than seeking an alternative home for their money in the retail market.

An alternative solution, which is widely available in the UK, is a deferred benefits plan. Employers can transfer the funds of employees who have left their employment into the plan and all further administration of the benefits is carried out by the plan trustees. Some providers, including Zurich, offer this type of plan in the international market.

Read more about the Zurich International Deferred Benefits Plan.

Looking to the future, today

Because of increasing longevity, people need to save more, or for longer, so companies face the risk of people staying on in work because they can’t afford to retire. And from a changing workforce perspective, Millennials are not that interested in working for a single employer – they expect to be mobile in the geographic sense and mobile across employers.

So are the long-term savings arrangements being set up today going to be flexible enough to meet the future needs of employees? And how do they satisfy the compliance and cost constraints that companies face?

Through an IPP that allows regular withdrawals, employers have the opportunity to shape plan design, close the pensions savings gap, and empower employees on the move to create the retirement they want.

In our next article we will look at how to effectively communicate the benefits of the plan to employees.

Find more information about our award-winning International Pension Plan and other savings solutions here.