Managed Funds

An actively managed solution with a distinguished history

Managed for more than 30 years by Columbia Threadneedle Investments, the Zurich Managed Funds are global funds, with a higher bias towards your chosen fund currency. Whilst the main asset classes are equities and fixed income, an active approach to asset allocation allows the Fund Manager to dynamically adjust these allocations within a controlled framework set by Zurich.

Zurich Managed Funds apply the following key investment principles

Choice

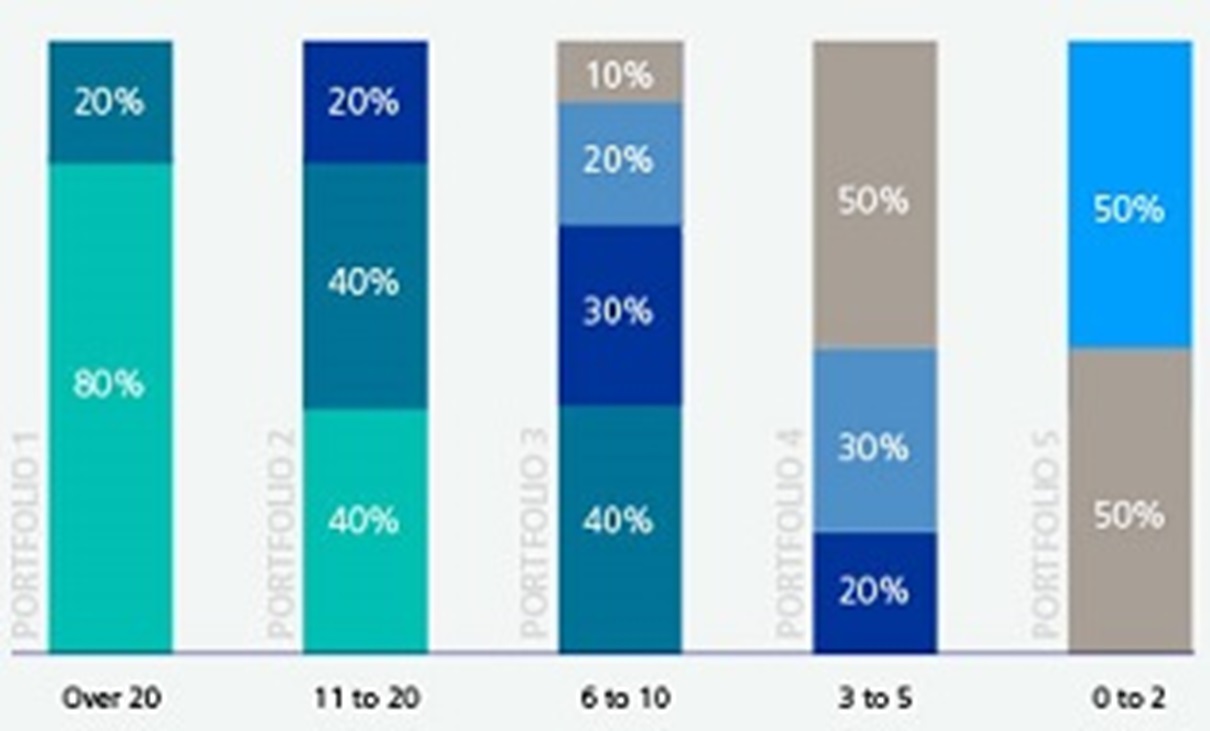

The funds offer five levels of risk which can be used in various combinations to suit the investor’s risk profile

Active management

The funds are actively managed with a disciplined approach at both asset allocation and security level

Diversified sources of return

The funds look to take advantage of three sources of return; asset allocation, investment themes and stock selection

Heritage

A proven track record, with extensive experience of managing asset allocation mandates

It is these key principles, which have been refined over many years, that help to define the underlying structure and asset allocation.

Client risk appetite

Each fund has a different mix of investments to align with a range of investor profiles, from the lower risk / lower return Defensive Fund, through to the higher risk / higher return Adventurous Fund. The Funds are available in three currencies; US dollar (USD), Euro (EUR) and Sterling (GBP).

Equity Bonds

See how they work

Find out more about Zurich Managed Funds and CTI

Knowledge Centre

Become a smart investor

Understand how funds work

Factsheets

Factsheets Factsheets

Factsheets Factsheets

Factsheets Factsheets

Factsheets Factsheets

Factsheets